Global Refinance Market Forecast to Nearly Double by 2034

Market set to grow from USD 24.49B in 2026 to USD 46.17B at an 8.2% CAGR, driven by borrower demand.

As borrowers increasingly pursue refinancing to optimize financial flexibility & reduce costs innovation in digital platforms & competitive interest products is accelerating engagement across consumer”

PUNE, MAHARASHTRA, INDIA, February 10, 2026 /EINPresswire.com/ -- The global refinance market is projected to achieve significant growth through the next decade, fueled by increasing demand for flexible financial solutions and competitive interest rates, according to a recent research report published by Fortune Business Insights™.— Fortune Business Insights

The report indicates that the global refinance market was valued at USD 22.82 billion in 2025 and is expected to grow from USD 24.49 billion in 2026 to USD 46.17 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 8.2% during the forecast period.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/refinance-market-115139

Refinancing refers to the replacement of an existing loan with a new one under more favorable terms, such as lower interest rates, shorter repayment periods, or adjusted monthly payments. Borrowers — including individuals and businesses — are increasingly tapping into refinancing options as they confront dynamic financial landscapes and seek strategies to optimize debt management and improve cash flow.

Market Drivers and Growth Factors

A key driver of refinance market expansion is the growing demand for low-interest refinancing options. Borrowers are actively pursuing opportunities to refinance existing debts — including mortgages and other loan types — to secure more favorable interest rates and reduce total borrowing costs. This trend is particularly pronounced among consumers holding variable-rate loans who are seeking stability through fixed-rate options. As competitive rates emerge, demand for refinancing solutions continues to strengthen.

Additionally, an increase in consumer awareness about the potential benefits of refinancing and the ease of accessing competitive rates through digital and traditional channels is supporting market growth. As borrowers become more informed about refinancing alternatives, both individual and business refinancing activity is expected to rise.

The report also highlights that major industry participants — including banks, credit unions, and digital lenders — are investing in innovative refinancing solutions and expanding their offering portfolios to meet evolving borrower preferences. These initiatives are broadening access to refinance products and enhancing the customer experience.

Market Trends

One significant trend in the refinance market is the increasing shift toward digital and online refinancing platforms. Consumers are embracing the convenience of completing loan applications, processing, and loan closures remotely. Digital platforms are simplifying refinancing workflows by integrating advanced technologies such as automation and artificial intelligence, which help streamline the process, reduce turnaround times, and minimize errors.

Borrowers are showing a preference for fully online refinancing experiences that reduce paperwork and eliminate the need for in-person interactions. This shift is especially prominent among tech-savvy borrowers who value speed, transparency, and ease of comparison shopping across lenders.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/refinance-market-115139

Market Segmentation

The refinance market is segmented by type, channel, and end user to provide a detailed understanding of demand across different borrowing categories and delivery models.

By Type

Market types include mortgage refinancing, auto loan refinancing, student loan refinancing, personal loan refinancing, and others. Mortgage refinancing accounted for the largest portion of the market share, supported by homeowners seeking to lower monthly payments, reduce loan terms, or free up equity for home improvements or other financial needs.

Auto loan refinancing is projected to grow rapidly, with a higher-than-average CAGR as vehicle owners look to refinance existing auto loans to secure better terms and costs in a fluctuating interest rate environment.

By Channel

The refinance market is also categorized by delivery channel: online platforms, financial institutions/banks, and brokers and agents. In 2025, financial institutions and banks dominated the global market, leveraging their established infrastructure, broad product portfolios, regulatory experience, and trust with borrowers.

However, online platforms are projected to grow at a faster rate, reflecting the growing consumer preference for remote, technology-enabled loan processes that enhance convenience and speed while offering real-time rate comparisons.

By End User

The market’s end-user segmentation includes individual consumers and businesses. Individual consumers currently account for the majority market share, driven by heightened borrower interest in reducing monthly payments, accessing home equity, and optimizing loan terms. The individual segment is expected to sustain robust growth throughout the forecast period.

Businesses also contribute to refinance activity, particularly in sectors seeking to restructure debt, improve cash flows, or fund strategic investments. Commercial refinancing — while smaller in share compared with consumer refinancing — represents an expanding segment.

Regional Insights

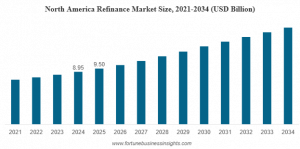

Geographically, North America dominated the refinance market in 2024 and 2025, with a valuation of approximately USD 9.50 billion in 2025. This region’s leadership stems from its robust financial infrastructure, high rates of homeownership, and widespread consumer adoption of refinancing solutions. Within North America, the United States accounted for roughly 34.0% of global refinance market revenues, underscoring its central role in refinancing activity.

Europe is the second-largest market region, supported by increasing consumer awareness, favorable interest rate conditions, and rising homeownership rates in markets such as the United Kingdom, Germany, and France. These factors are driving individuals and businesses to explore refinancing options.

In the Asia Pacific, refinance market activity is also notable, with strong growth in countries such as China and India. A growing middle class, expanding financial services sectors, and increasing uptake of refinancing products support the market’s expansion across this region.

South America and the Middle East & Africa are expected to witness moderate growth in refinance activity over the forecast period, supported by rising consumer awareness of refinancing options, improving financial services infrastructure, and demand for affordable financial solutions.

Request For Customization - https://www.fortunebusinessinsights.com/enquiry/customization/refinance-market-115139

Competitive Landscape

The refinance market landscape is competitive and features a range of traditional and digital lending institutions that are innovating to capture market share. Key players profiled in the report include major lenders and mortgage service providers such as Rocket Mortgage, Chase (JPMorgan Chase), United Wholesale Mortgage (UWM), SoFi Technologies, Navy Federal Credit Union, PenFed Credit Union, CrossCountry Mortgage, AmeriSave Mortgage, Veterans United Home Loans, and loanDepot.com, LLC.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.