Canopy Connect and Holistiplan Announce Integration to Automate Insurance Planning

New integration brings insurance into the financial planning conversation

By embedding verified P&C policy data directly into planning conversations, we’re helping advisors move faster and deliver more confident, comprehensive insights to their clients.”

BEAVERTON, OR, UNITED STATES, January 28, 2026 /EINPresswire.com/ -- Canopy Connect, the leading insurance verification technology provider, and Holistiplan, a comprehensive financial planning platform serving 55,000+ financial professionals, today announced their integration to bring automated property and casualty insurance analysis into the financial planning workflow. The partnership enables advisors to retrieve verified policy data from more than 300 insurance carriers in seconds, eliminating the document collection bottleneck that has prevented widespread adoption of insurance planning.— Tolga Tezel, Founder and CEO of Canopy Connect

By automating insurance data collection, Holistiplan enables financial advisors to deliver comprehensive risk management reviews without the document-chasing that traditionally prevented insurance planning adoption. With verified policy data flowing directly into the platform, advisors can instantly identify coverage gaps and evaluate liability limits as part of their annual planning conversations.

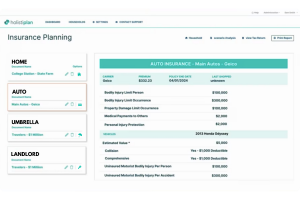

Through this integration, Canopy Connect's 250+ standardized policy fields enable Holistiplan to automatically surface coverage recommendations across home, auto, landlord and umbrella policies. Financial advisors can now transition from reactive insurance conversations to proactive risk management strategies within the same platform they already trust for tax and estate planning.

“Holistiplan has built one of the most trusted platforms in financial planning, and this integration brings insurance data into that workflow in a way the industry has been missing for years,” said Tolga Tezel, founder and CEO of Canopy Connect. “By embedding verified P&C policy data directly into planning conversations, we’re helping advisors move faster and deliver more confident, comprehensive insights to their clients.”

“Canopy Connect’s technology fundamentally changes what’s possible in insurance planning by removing the manual data gathering that has held advisors back for so long,” said Roger Pine, cofounder and CEO at Holistiplan. “This integration allows our users to deliver meaningful insurance insights with the same speed and accuracy they expect from Holistiplan’s tax and estate planning tools.”

Holistiplan's unified planning ecosystem covers tax planning, insurance analysis, and estate planning. The Canopy Connect integration brings insurance planning into parity with Holistiplan's tax intelligence capabilities, positioning it as the first tax-planning platform to offer fully automated P&C policy discovery and analysis powered by direct carrier connections.

Learn more about the integration at: https://www.usecanopy.com/integrations/holistiplan

About Holistiplan

Holistiplan is a fast-growing, fast-paced company within the Financial Technology (FinTech) sector. With more than 50,000 users, our award-winning software allows financial planners to turn their clients’ tax returns into a customized tax report within seconds. We believe it’s the future of tax planning, and the nearly ten thousand financial planning firms we’ve added as subscribers in our first four years seem to agree. Holistiplan has been voted the #1 tax planning software in the 2021, 2022, 2023, and 2025 Kitces Report Studies and the #1 tax planning software for 5 consecutive years in the T3 / Inside Information Software Surveys. Learn more at https://www.holistiplan.com

About Canopy Connect, Inc.

Canopy Connect™ is the leader in insurance verification technology, giving businesses the ability to retrieve verified insurance information directly from insurance carriers in seconds and deliver data directly into other systems via API. Through its consumer consent-driven data sharing technology and secure cloud infrastructure, Canopy Connect’s solutions allow insurance agencies, carriers, lenders, auto dealers, insurance innovators, and other businesses to deliver delightful, intelligent, and frictionless insurance services. Learn more at https://www.usecanopy.com

Ray Huang

Canopy Connect, Inc.

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

TikTok

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.