ChainThat Marks a Decade of Innovation with the Launch of Gen AI-Powered Beyond Insurance Accounting Platform

A next-generation accounting platform combining AI-based ingestion, reconciliation and reporting to transform insurance finance operations.

It’s been 10 years since we founded ChainThat with a vision to transform insurance operations. Today, the launch of BIA represents a defining milestone in that journey.”

LONDON, UNITED KINGDOM, December 2, 2025 /EINPresswire.com/ -- At the mark of its 10-year anniversary, ChainThat announces the launch of Beyond Insurance Accounting (BIA), a next-generation financial operations platform that unifies Billing, Payments and Accounting into one intelligent, connected, real-time system, purpose-built for the complexities of modern insurance.— Vikas Acharya - CEO, ChainThat

For a decade, ChainThat has helped insurers transform underwriting, claims and multinational programmes. BIA marks the company’s expansion into a critical and long-neglected area: insurance finance, where manual cash reconciliation, delayed reporting and fragmented systems have become the industry’s silent efficiency drain.

BIA tackles this head-on by providing one compliant, automated ledger that brings operational clarity and financial integrity across insurers, MGAs, brokers and their partners. It delivers accurate, audit-ready data, real-time control, and faster period closures, replacing spreadsheets, workarounds and legacy financial silos.

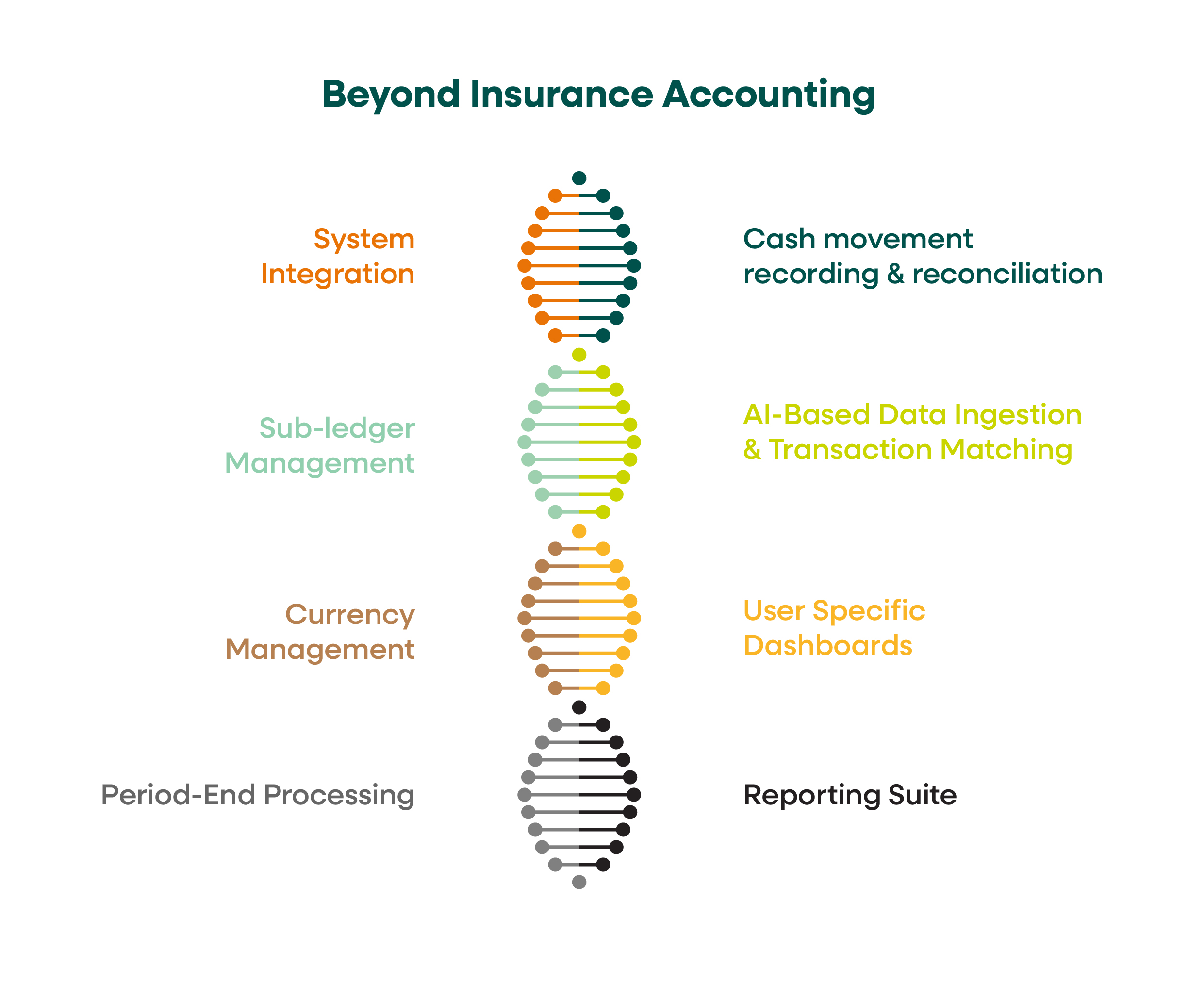

Beyond Insurance Accounting integrates core finance functions, including Cash Movement Recording and Reconciliation, AI-Based Data Ingestion and Transaction Matching, Sub-ledger Management, User Specific Dashboards and a full Reporting Suite within a single connected system. Built on ChainThat’s DNA framework, BIA brings these components together so data moves seamlessly from ingestion through journals, sub-ledgers, reconciliations and final reporting, enabling finance teams to reduce manual effort, improve accuracy and close periods with confidence.

“It’s been 10 years since we founded ChainThat with a vision to transform insurance operations. Today, the launch of BIA represents a defining milestone in that journey,” said Vikas Acharya, CEO at ChainThat. “Since the beginning, our mission has been to engineer solutions that remove friction and unlock growth. BIA is both a pain reliever and a gain creator; it restores financial integrity, strengthens control, and sets a new standard for operational excellence. This platform reflects our relentless commitment to innovation and our belief that the future of insurance finance should be intelligent, connected, and effortless.”

BIA has been shaped under the product leadership of Steve Morgan, Head of Analysis and Product Owner at ChainThat, who brings more than 40 years of insurance experience to the platform’s design. The result is a system intentionally aligned to how insurance finance teams work, one that simplifies complexity and eliminates friction while improving accuracy and operational clarity. “This platform gives finance teams the control and efficiency they’ve been asking for,” said Morgan. “It finally brings everything together.”

Alongside its unified financial workflow, BIA introduces a secure and scalable foundation that supports multi-tenant structures, PAS integrations, auditability and banking connectivity. With Gen-AI assisted ingestion and automated matching at its core, the platform ensures that every financial event, regardless of source, is validated, traceable and ready for reporting.

“Our focus from day one was to engineer a platform that is modular, secure, scalable and dependable,” said Praveen Nagpal, Chief Technology Officer at ChainThat. “BIA provides the technology backbone organisations need for confident, compliant and future-proof financial operations.”

Beyond Insurance Accounting (BIA) is available to insurers, MGAs and brokers globally and integrates seamlessly with one or more policy administration systems, enabling insurance organisations to unify finance operations even in complex or multi-regional environments. Designed to evolve alongside regulatory and market demands, BIA provides a foundation for long-term operational transformation and financial excellence.

About ChainThat

ChainThat is a leading insurtech company based in London, dedicated to developing technology platforms that help insurance organisations realise their full potential. ChainThat empowers insurers, MGAs, brokers, and other insurance intermediaries to activate growth and achieve their business potential through intuitive SaaS-based platforms. Since 2015, ChainThat has been delivering enterprise-grade technology that simplifies and accelerates insurance operations. For more information about BIA visit www.chainthat.com/bia/

Valentina Lusso

ChainThat

email us here

Visit us on social media:

LinkedIn

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.