Buy Now Pay Later (BNPL) Market Size Worth USD 83.36 Bn by 2034 Driven by E-commerce and Digital Payment Growth

According to Precedence Research, the global buy now pay later (BNPL) market size is expected to be worth USD 83.36 billion by 2034 up from USD 19.22 billion in 2024. Rising e-commerce adoption and flexible payment demand drive the market.

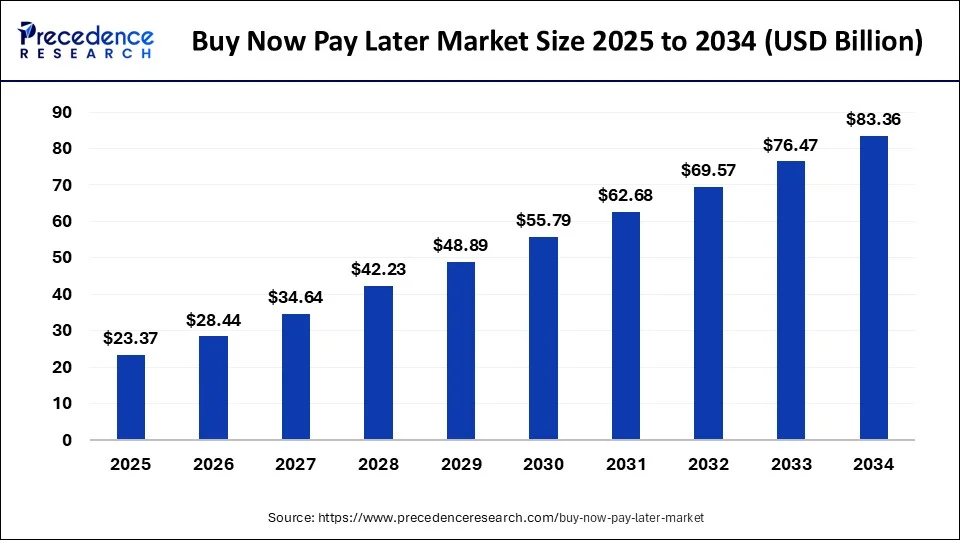

Ottawa, Aug. 13, 2025 (GLOBE NEWSWIRE) -- The global buy now pay later (BNPL) market size is calculated at USD 23.37 billion in 2025 and is expected to rise from USD 28.44 billion in 2026 to nearly USD 83.36 billion by 2034. Between 2025 and 2034, the worldwide market is expanding at a solid CAGR of 8.28%.

The BNPL market is driven by rising consumer demand for flexible payment options, rapid digitalization in retail, and growing preference for interest-free credit solutions.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1559

Buy Now Pay Later Market Key Highlights:

- In terms of revenue, the global buy now pay later market reached USD 19.22 billion in 2024.

- It is projected to hit USD 83.36 billion by 2034.

- The market is expected to expand at a double-digit CAGR of 15.18% from 2025 to 2034.

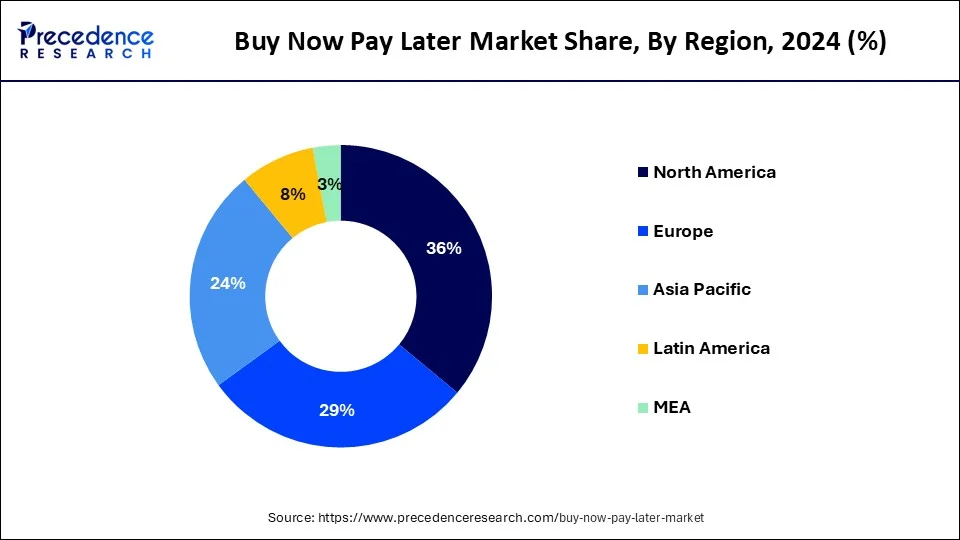

- Asia Pacific accounted for the largest market share of 36.42% in 2024.

- North America is poised to grow at a notable CAGR of 15.11% from 2025 to 2034.

- By component, the platform/solution segment contributed the highest market share of 67% in 2024.

- By purchase ticket size, the small ticket item (Up to US$ 300) segment held the biggest market share of 42.98% in 2024.

- By purchase ticket size, the mid ticket items (US$ 300 - US$ 1000) segment is projected to grow at a notable CAGR of 15.84% from 2025 to 2034.

- By business model, the business-driven segment accounted for the major market share of 70.99% in 2024.

- By business model, the customer-driven segment is growing at a solid CAGR of 15.49% from 2025 to 2034.

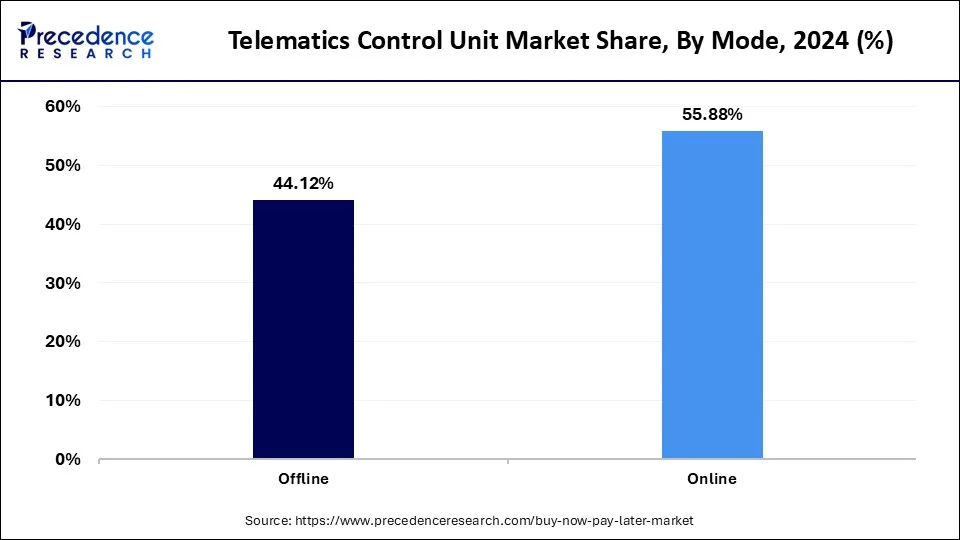

- By mode, the online segment captured the largest market share of 55.88% in 2024.

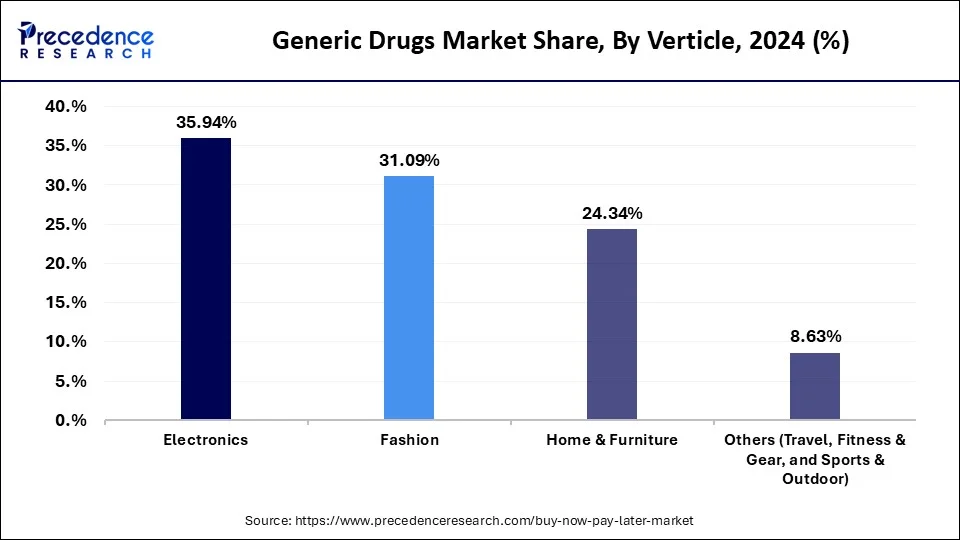

- By vertical, the electronics segment held the major market share of 35.94% in 2024.

- By vertical, the fashion segment is registering a notable CAGR of 15.53% during the forecast period.

Buy Now Pay Later Market Revenue Analysis 2022 to 2024

Buy Now Pay Later Market Revenue (USD Million) by Mode 2022-2024

| Mode | 2022 | 2023 | 2024 |

| Online | 2,870.1 | 3,486.0 | 4,237.9 |

| Offline | 2308.9 | 2,778.2 | 3,345.9 |

Buy Now Pay Later Market Revenue (USD Million) by Verticle 2022-2024

| Verticle | 2022 | 2023 | 2024 |

| Home & Furniture | 3,149.30 | 3,837.03 | 4679.1 |

| Electronics | 4,703.60 | 5,697.73 | 6908.2 |

| Fashion | 4,007.99 | 4,891.83 | 5975.8 |

| Others | 1,178.39 | 1,397.88 | 1658.9 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1559

Buy Now Pay Later Market Overview and Potential

What is Buy Now Pay Later?

Buy now pay later is a kind of financing that enables its customers to receive goods or services at the present moment and repay them later as a result of interest-free down payments. The fast development of online businesses has contributed much to the growth of the BNPL market, with online customers being more inclined to payment options that are convenient, fast, and frictionless.

The popularity of smartphones, use of mobile banking, and digital wallets has also provided an added speed to the adoption of BNPL. BNPL is a widely used payment method that has changed consumer buying habits and is the major growth driver in the new retail and fintech environments.

Top 5 Global Buy Now Pay Later Platforms:

| Sr. No. | Platforms | Highlight |

| 1. | Openpay | Openpay was established in 2013 in Australia with the focus to serve BNPL organizations in high-value industries, such as the automotive, home improvement, and healthcare sectors. In 2019, it opened the OpyPro B2B SaaS platform. |

| 2. | Klarna | Incorporated in 2005 in Sweden, Klarna is a successful BNPL provider that has more than 150 million customers in 45 countries and 450,000 cooperation partners. It also uses an app and has price alerts and a Vibe rewards program. |

| 3. | Splitit | Splitit, which was launched back in 2012, enables interested customers to pay with existing credit cards and split costs into interest-free installments without any credit checks. In April 2023, it introduced SplititExpress, a blazingly fast checkout. It has integrations with Shopify, WooCommerce platforms, and it supports Visa, Mastercard. |

| 4. | Affirm | Affirm, which was co-founded by PayPal co-founder Max Levchin, took its IPO in 2021. It collaborates with the largest retailers of the U.S, such as Amazon or Walmart. It's reported that GMV as of 2023 is US$20.2 billion, and the number of users is 18 million. |

| 5. | PayPal Pay in 4 | Paypal Pay in 4 makes purchases between US$30 and US$1,500 and breaks them out into four interest-free payments over 6 weeks with soft credit checks. It enjoys strong acceptance among both online and in-store merchants to boost conversions up to 30%. PayPal is associated with a massive 426 million user base across the globe. |

Buy Now Pay Later Market Opportunity:

What is an Opportunity for the Buy Now Pay Later Market?

Customization of Services and Combination of Communities

One of the main upcoming trends in the BNPL market is the possibility of combining BNPL services with popular retail and online services. Large retailers are turning to BNPL more to improve their checkout experience and lower the rate of cart abandonment. Such a tendency is supported by the adaptation of BNPL products to the individual needs of consumers, including flexible payment schemes and third-party connections to their mobile and web environments to create an efficient user experience. Such integrations and customization improve the shopping experience, also generate loyalty and sales, hence making BNPL a key element of the retail and e-commerce agendas.

Key Challenges in the Buy Now Pay Later Market:

What is the Limitation for the Buy Now Pay Later Market?

Regulatory Scrutiny and Consumer Credit Risk

One significant constraint of the market is the increasing regulatory attention on reducing credit risks to consumers. With the popularity of the BNPL model comes the worry that people are acquiring unmanageable debts because it is easy to get into, and checks on credit are low. Regulatory organizations are coming up with more sanctions, like increased transparency, fair lending, and explicit provisions of payment details and penalties. One of them is a more rigid system in credit analysis, uniformity in reporting fees, and reporting BNPL in credit reports.

Scope of Buy Now Pay Later Market

| Report Attributes | Key Statistics |

| Market Size in 2024 | USD 19.22 Billion |

| Market Size in 2025 | USD 23.37 Billion |

| Market Size in 2026 | USD 28.44 Billion |

| Market Size in 2030 | USD 62.68 Billion |

| Market Size by 2034 | USD 83.36 Billion |

| Growth Rate 2025 to 2034 | CAGR of 15.18% |

| Base Year | 2024 |

| Leading Region in 2024 | Asia Pacific (36.42% market share) |

| Fastest Growing Region 2025-2034 | North America (CAGR of 15.11%) |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Historic Years | 2021 to 2023 |

| Segments Covered | Component, Vertical, Mode, Business Model, Purchase Ticket Size, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

| Key Players | Sezzle, Afterpay, Klarna Bank AB, Laybuy Group Holdings Limited, Quadpay, Splitit, Affirm Holdings Inc., Payl8r (Social Money Ltd.), PayPal Holdings Inc., and Perpay. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Buy Now Pay Later Market Key Regional Analysis:

How Big is the Asia Pacific Buy Now Pay Later Market?

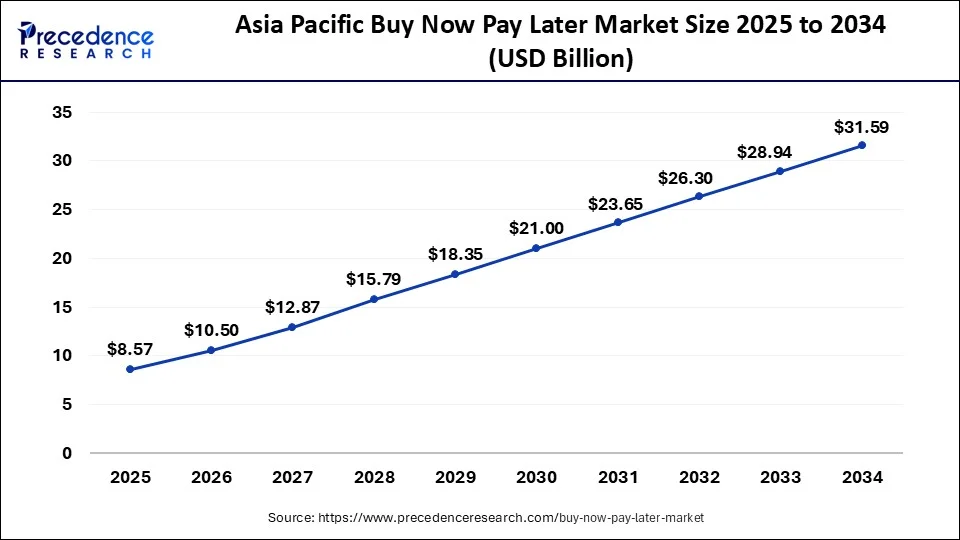

According to Precedence Research, the Asia Pacific buy now pay later market size was valued at USD 7.00 billion in 2024 and is expected to hit around USD 31.59 billion by 2034. The APAC market is poised to grow at a double-digit CAGR of 15.60% from 2025 to 2034.

How Aisa Pacific Dominated the Buy Now Pay Later Market?

Asia Pacific dominated the buy now pay later market in 2024 because of the high population growth, increasing digitalization rate, and tech-savvy consumer base. There has been a massive proliferation of the internet and smartphone usage in countries such as China, India, and those in Southeast Asia, which has stimulated the market need for convenient and seamless digital payment. The highly competitive and profitable e-commerce environment in the region helped shape the extensive penetration of BNPL services.

What are the Major Trends in India & China Buy Now Pay Later Market?

India

-

Rapid Digital Adoption: The surge in smartphone penetration and digital payments has fueled BNPL adoption, especially among young and urban consumers.

-

E-commerce Growth Driver: Expanding online retail and increasing affordability needs are pushing consumers to opt for BNPL as a convenient credit alternative.

-

Regulatory Environment: The Reserve Bank of India is working on frameworks to regulate BNPL, which could boost consumer confidence and market growth.

- Emerging Players: Homegrown fintech startups like ZestMoney, Simpl, and LazyPay are rapidly innovating and expanding across sectors, from retail to travel.

China

-

Mature Digital Ecosystem: China’s BNPL market benefits from advanced digital payment infrastructure and widespread use of mobile wallets like Alipay and WeChat Pay.

-

Integration with E-commerce Giants: BNPL services are deeply embedded within platforms like Alibaba and JD.com, driving massive transaction volumes.

-

Consumer Credit Culture: Chinese consumers are accustomed to credit-based purchases, supporting BNPL growth across both online and offline retail.

- Regulatory Scrutiny: The government has increased oversight on credit products, including BNPL, to ensure responsible lending and financial stability.

Why is North America the Fastest-Growing in the Buy Now Pay Later Market?

North America experiences the fastest growth in the market during the forecast period. Fintech firms are also partnering with entertainment and hospitality providers to include the option of BNPL application to make reservations and stay. This has had a massive demand increase as the popularity of BNPL products rises among Gen Z and millennials who prefer short-term, interest-free payments as the cost-of-living pressures are increasing.

How Bis is the U.S. Buy Now Pay Later Market?

The U.S. buy now pay later market size is expected to exceed USD 15.94 billion by 2033 increasing from USD 4.96 billion in 2025. The U.S. buy now pay later market is driven by improved consumer affordability and financial freedom.

U.S. Buy Now Pay Later Market Growth Factors:

- Smaller, interest-free payments are provided via Buy Now Pay Later (BNPL), attractive to customers on a tight budget or looking to spread out expenses.

- Growth in e-commerce drives using BNPL as platforms include it to provide a more seamless purchasing experience.

- A smooth interaction with online checkout processes makes instant credit access possible.

- Younger generations welcome the digital aspect and financial control of BNPL.

- More merchants are starting to accept BNPL as a form of payment to draw clients and raise average order value.

- More BNPL access is made possible by enhanced risk assessment and data analytics technologies.

- BNPL growth can be increased by government assistance for alternative payment methods.

- Players extend their product offers, add new features, and offer tailored experiences to draw in customers.

- Customers may find BNPL more appealing during recessions because of its affordability.

- Underbanked populations can be reached by BNPL, expanding the pool of potential users.

Don’t Miss the Latest U.S. BNPL Growth Forecast — Download Now ➡️ https://www.precedenceresearch.com/sample/3842

Buy Now Pay Later Market Segmentation Analysis:

Component Analysis:

The platform/solutions segment dominated the buy now pay later market in 2024. These platforms have the technological framework in place that links the consumers, merchants, and BNPL providers, facilitating easy and secure payment through the digital and in-store platforms. They have advanced functionality, including prevention of fraud, real-time credit checks, processing payments, and authenticating and identifying customers, and this is necessary in ensuring the maintenance of trust as well as the efficiency of operations.

Mode Analysis:

The online segment dominated the buy now pay later market in 2024, owing to increased e-commerce and mobile commerce. The BNPL can be applied to mobile-friendly interfaces has also enhanced its leading position online since increasingly consumers use smartphones and tablets to make purchases. Because of the popularity of online channels and the increasing need to have the convenience of flexible payment methods, BNPL will manage to remain strong in the online channel and make it the most powerful distribution segment.

The offline segment is the fastest-growing in the market during the forecast period. The growing consumer demand in physical stores to use flexibility in payment has motivated retailers to offer BNPL at the point of sale. Upgraded technology in making payments in-store, namely QR code scanning and integrated card readers, enables hassle-free transactions with BNPL in physical stores.

Purchase Ticket Size Analysis:

The small ticket item (Up to US$300) segment held the largest share in the buy now pay later market in 2024. The BNPL service at the small ticket level allows buyers to purchase goods without having to pay the total bill, but to take payment in small instalments with the flexibility of budgeting money and better financial management. With rising e-commerce and mobile shopping, the easy-to-go method of frequent small purchases with BNPL offers more advantages.

Business Model Analysis:

The business-driven segment dominated the buy now pay later market in 2024, attributed to the large number of merchants and e-commerce stores offering BNPL solutions. Retailers in many industries, starting with fashion and electronics, through to travel and healthcare, have added BNPL payments to their checkout to improve the customer experience and increase sales. This segment is also fortified by providers offering tools such as marketing support services, customer analytics, and easy payment integration in the service of merchants.

Vertical Analysis:

The electronics segment held the largest share in the buy now pay later market in 2024. Consumer electronics, including smartphones, laptops, tablets, and home appliances, are usually expensive items that need an initial high investment. Moreover, the sphere of e-commerce and electronic vendors remains instrumental in promoting BNPL services via numerous collaborations with the companies providing these services, since the product dominating in BNPL remains electronics.

The fashion segment experiences the fastest growth in the market during the forecast period. Consumers are indeed more fascinated by interest-free flexible payments when it comes to purchasing clothing, footwear, or accessories, especially when accompanied by frequent discounting and seasonal promotions. This model is especially appealing to the Gen Z and millennial generation of consumers who value convenience, low price, and quick product accessibility.

➡️Related Topics You May Find Useful:

✚ Middle East Buy Now Pay Later Market: Explore how digital payment adoption and youthful demographics are fueling BNPL growth across the Middle East

✚ Payment Processing Solutions Market: Examine the evolving technologies and partnerships shaping secure, efficient global payment ecosystems

✚ Subscription E-Commerce Market: See how personalized experiences and convenience are driving subscription-based online retail models

✚ Embedded Finance Market: Understand how seamless financial service integration is redefining customer engagement across industries

✚ Proximity Payment Market: Track the surge in tap-and-go transactions driven by mobile wallets and contactless innovations

✚ Fintech as a Service Market: Discover how API-driven financial solutions are accelerating digital transformation for businesses

✚ Debt Settlement Market: Analyze market trends as financial hardship and consumer debt restructuring reshape settlement services

Buy Now Pay Later Market Leading Companies

The following industry leaders dominate the BNPL market, commanding the largest share and shaping the direction of global trends through their innovation, scale, and strategic influence.

- Sezzle

- Afterpay

- Klarna Bank AB

- Laybuy Group Holdings Limited

- Quadpay

- Splitit

- Affirm Holdings Inc.

- Payl8r (Social Money Ltd.)

- PayPal Holdings Inc.

- Perpay

Recent Developments:

- In June 2025, Klarna is a Swedish company, launched a pilot debit card in the U.S. to allow them to make instant payments or interest-free repayment. It has three color options and tiered benefits, such as cashback and discounts. Klarna targets to compete with conventional banks, even when the company lacks a banking permit in the U.S.

- In June 2025, Visa and Klarna announced a next-gen debit card at Money 20/20 Europe. The Klarna Card is a Visa Flexible Credential-powered card issued by WebBank, charged instantly, or on a Pay in 4 or Pay Later option, and comes with an FDIC-insured wallet to store users' funds within the card.

- In June 2025, FICO announced FICO Score 10 BNPL and Score 10 T BNPL as the first Buy Now Pay Later scores out of scores. These newly introduced scores are an expression of the increasing influence of BNPL loans on creditworthiness that allows improved risk assessment by lenders in the dynamic U.S. credit economy.

Case Study: Klarna’s BNPL-Backed Securities and LendingTree’s Consumer Usage Shift

Klarna, a leading BNPL provider with over 150 million users globally, recently partnered with Pagaya Technologies to issue $300 million in bonds backed by BNPL loans. This marks one of the first major securitizations in the BNPL space, with JPMorgan Chase and Apollo’s Atlas arranging the deal. The move allows Klarna to tap into institutional capital markets while scaling its Pay in 4 and Pay Later products, particularly in the U.S., where its market share is expanding.

Key Insights

- Financial Innovation: This securitization transforms BNPL receivables into investable assets, making BNPL a recognized class in structured finance—much like auto loans or credit card receivables.

- Risk and Opportunity: While the AAA-rated tranches offer competitive yields, higher-risk tranches attract premium returns due to consumer credit variability in BNPL.

-

Growth Implication: The deal positions BNPL as not just a retail payment method but a legitimate investment vehicle, opening doors for future institutional partnerships.

Consumer Behavior Spotlight (LendingTree Study, April 2025)

A LendingTree survey revealed that 25% of BNPL transactions are now used for groceries, up from 14% a year earlier. Usage among Gen Z has reached 64%, but 41% of all BNPL users reported at least one late payment. Many consumers use multiple BNPL accounts concurrently, with younger demographics driving adoption for everyday essentials rather than just big-ticket items.

Relevance to the Market

This dual development—financial market adoption through securitization and shifting consumer use toward daily necessities—highlights both the scalability and risk profile of BNPL. It underscores why regulatory oversight, like the measures noted in your press release, will be critical in balancing growth with responsible lending.

Stay Ahead of BNPL Market Shifts:

Leverage the latest market intelligence and real-world case studies to guide your next strategic move in the Buy Now Pay Later sector. From securitization trends to evolving consumer behavior, our insights help you make data-backed decisions with confidence.

Contact our research team today at sales@precedenceresearch.com or call +1 804 441 9344 to discuss tailored BNPL growth strategies for your business.

Buy Now Pay Later Market Segments Covered in the Report

By Component

- Platform/Solutions

- Services

By Purchase Ticket Size

- Small Ticket Item (Up to US$300)

- Mid Ticket Items (US$ 300 - US$ 1000)

- Higher Prime Segments (Above US$1000)

By Business Model

- Customer Driven

- Business Driven

By Mode

- Online

- Offline

By Vertical

- Home & Furniture

- Electronics

- Fashion

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1559

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

➡️ Explore More Market Intelligence from Precedence Research:

✚ Prepaid Card Market: Explore growth drivers for prepaid solutions in personal finance, travel, and corporate expense management

✚ Digital Commerce Market: Gain insight into the platforms and strategies powering global e-commerce expansion

✚ Alternative Accommodation Market: See how unique stays and peer-to-peer platforms are transforming the hospitality landscape

✚ Peer-to-Peer Lending Market: Understand how fintech platforms are enabling direct lending and expanding access to credit

✚ Contactless Payment Market: Discover the shift towards frictionless transactions in retail, transport, and everyday purchases

✚ Proximity Payment Market: Analyze consumer adoption trends for short-range digital payment technologies

✚ P2P Payment Market: Track the rapid growth of instant, mobile-enabled person-to-person transfers

✚ Healthcare Digital Payment Market: Explore how secure payment solutions are streamlining billing and patient engagement in healthcare

✚ M-Commerce Payment Market: See how mobile-first payment options are driving growth in shopping and service transactions

✚ In-Vehicle Payment Services Market: Understand innovations enabling seamless, on-the-go payments from connected cars

✚ Payment Processing Solutions Market: Examine secure, scalable systems supporting global payment acceptance and settlement

✚ Payment Security Market: Discover advanced solutions combating fraud and ensuring trust in digital transactions

✚ Outdoor Payment Terminal Market: Analyze demand for robust, weatherproof payment solutions in fueling stations, parking, and retail

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.